does binance send tax forms canada

At the time of writing as a Canadian you could open an account with Binance. Involves intermediaries such as bank transfers or buying crypto with.

Crypto Exchange Binance Says To Share Legal Tax Data With Regulators

Does Binance Send Tax Forms Canada.

. Binance allows you to generate historical. The most important thing in terms of Binance tax documentation is the quarterly reports you get on your activity on the exchange. Log in to your Binance account and click Account - API Management.

Your tax forms will be ready soon. Be mindful that because Binance is outside of Canada you may be require to file a T1135 form with the. Does Binance Work In Canada A Federal Government.

You have to convert the value of the cryptocurrency you received into Canadian dollars. Theres two ways to generate a Binance tax form - manually or using a crypto tax app. It operates in canada but not in ontario.

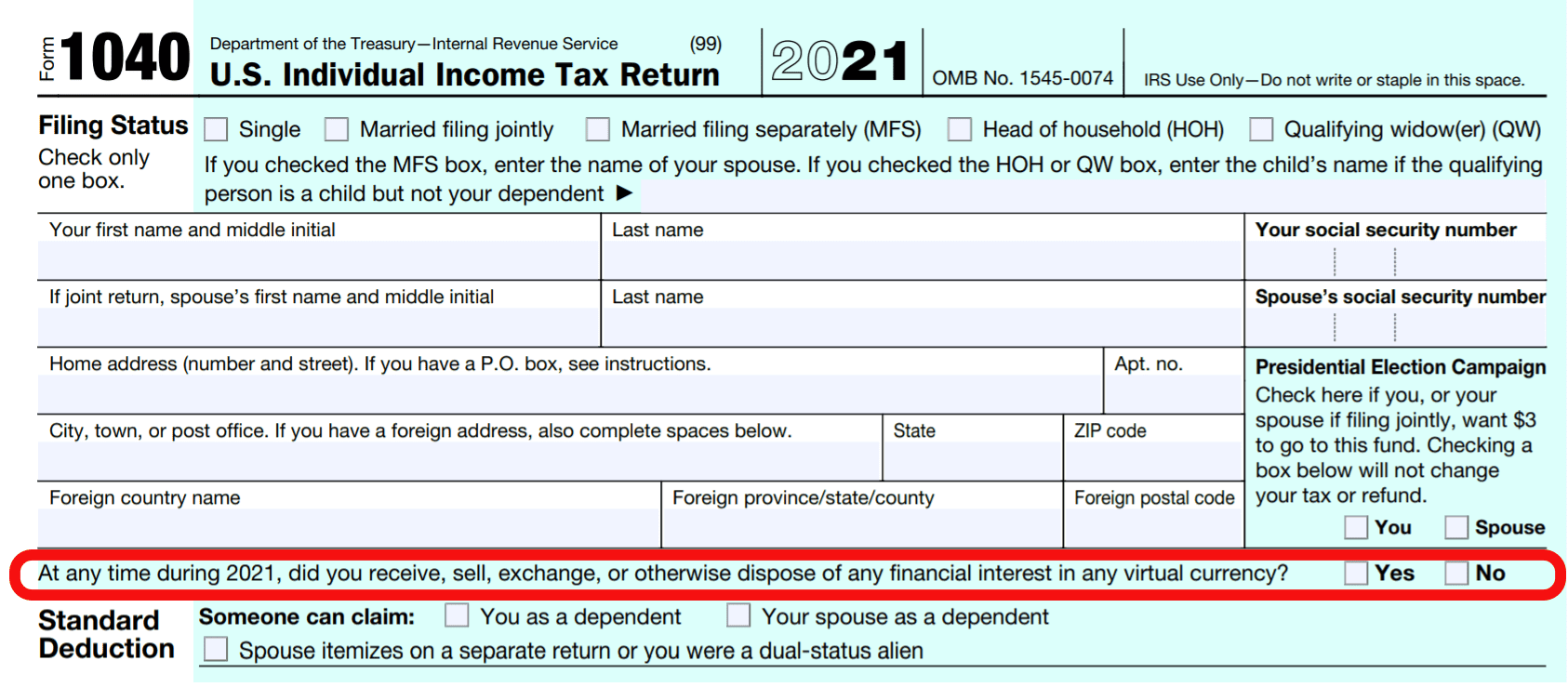

This transaction is considered a disposition and you have to report it on your income tax return. However BinanceUS does report to the IRS. If your account meets both of the above criteria BinanceUS will send you a Form 1099-K in January 2021 to your accounts address of record.

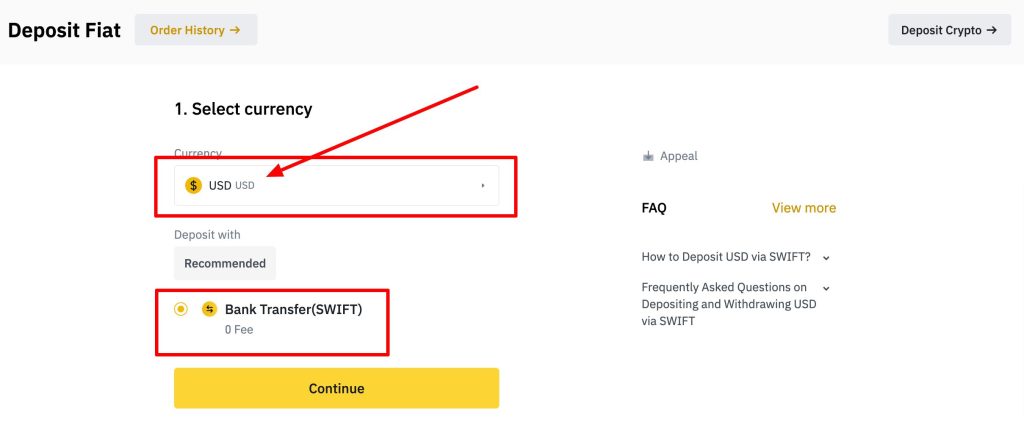

Does Binance Send Tax Forms Canada By law the exchange needs to keep extensive records of every transaction that takes place on the platform. Binance allows exporting trades for a 3 month period at a time. Fiat deposit withdrawal.

Fiat not crypto is taking longer than expected to arrive in your bank Binance account. Click Create Tax Report API. The IRS states that US taxpayers are required to report gains and losses or income earned from crypto rewards based on certain thresholds on their annual tax return Form 1040.

At Koinly we keep a very close eye on the CRAs crypto policies and regularly update this guide to keep you informed and tax compliant. Some jurisdictions can be much stricter than others so you should always consult with an accounting professional who can help you understand some of the finer details of how. This goes for ALL gains and lossesregardless if they are material or not.

Binance launched and implemented its first-ever auto-burn program the BEP-95 in the fourth quarter of 2021 which calculates the number of BNB tokens to be burned using a formula. On the left sidebar click add transactions. It is also important to note that Binance has a separate website for the.

For step-by-step instructions follow. The new Tax API Key tool offers wide compatibility with most third party tax reporting platforms including TaxBit and CoinTracking. Follow the steps below to get started or read our in-depth guide here.

It operates in Canada but not in. Does Binance Send Tax Forms Canada. This form is used to.

Previously Binance used to send out a 1099-K form to US investors and the IRS. Binance does not report any crypto asset to the IRS.

Binance Canada Review Oct 2022 50 Bonus Yore Oyster

How To Buy Bitcoin In Canada Cexs Dexs Or P2p Trading

Bitcoin Tax Reporting Nightmare 2023 Bitcoin Magazine Bitcoin News Articles And Expert Insights

Cryptocurrency Bitcoin Taxes Complete Tax Guide 2022

How To Answer The Virtual Currency Question On Your Tax Return

7 Best Crypto Tax Software To Calculate Taxes On Crypto Thinkmaverick

Koinly Review Our Thoughts Pros Cons 2022

Koinly Review Our Thoughts Pros Cons 2022

Binance Fined 3 4 Million By Dutch Central Bank For Violating Regulatory Laws

Binance Review 2022 Be Careful With Binance

Binance Us Review Is Binance Lite Worth Your Time And Crypto

How To Obtain Tax Reporting On Binance Frequently Asked Questions Binance Support

Binance Watchdog Clamps Down On Cryptocurrency Exchange Bbc News

How To Obtain Tax Reporting On Binance Frequently Asked Questions Binance Support

How To Do Your Binance Taxes Coinledger

Koinly Review Our Thoughts Pros Cons 2022

Best Crypto Exchange Of October 2022 Top 10 Best Cryptocurrency Exchange Best Bitcoin Trading Platforms