virginia electric vehicle tax credit 2020

44 Electric Car Tax Credit 2020 Virginia. In addition to credits virginia offers a number of deductions and subtractions from income that may help reduce your tax liability.

12 500 Ev Tax Credit Off The Table Carsdirect

I havent been ale to find specific.

. Find out which ev tax credits are available. If you take home a new PEV that meets. Electric Vehicle EV Fee EV owners must pay an annual highway fee of 11649 in addition to standard vehicle registration fees.

Code 581-2402 Virginia levies a 415 Motor Vehicle Sales and Use SUT Tax based on the vehicles. The credit ranges between 2500 and 7500 depending on the capacity of the battery. Beginning July 1 2022 EV drivers may choose to enroll in a.

Motor Vehicle Sales and Use Tax. Rebates can be claimed at or after purchase while tax credits are. Get more power than ever with Nissan Electric Vehicles.

Effective July 1 2016 unless exempted under Va. Download and complete the License Plate Application VSA 10 including the vehicle identification number VIN and title number. DMV Registration Work Center PO.

In addition to credits Virginia offers a number of deductions and. Aug 26 2022 1218 AM EDT. The fee is included with registration fees and must be.

Owning an electric car can also be environmentally friendly substanial. Federal Tax Credits The state of Virginia is not the only sector willing to reward customers for the purchase of an EV as well as a Plug-In Hybrid PEV. The two- or three-wheeled plug-in electric drive motor vehicle tax credit had been extended through December 31 2020 by Public Law 116-94.

The qualified plug-in electric drive motor vehicle credit is a nonrefundable federal tax credit of up to 7500 according to Jackie Perlman. Build Price Locate A Dealer In Your Area. Ad The future of driving is electric.

Electric vehicles that get 200 or more miles of range would qualify for a 2000 rebate for new and 1000 for a used vehicle. Review the credits below to. Check that your vehicle made the list of qualifying clean fuel vehicles.

A vehicle that gets between 120 and 200 miles. All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7500. Reference Virginia Code 332-501 and 462-7493 Green Jobs Tax Credit Qualified employers are eligible for a 500 tax credit for each new green job created that offers a salary of at least.

NEXSTAR After a summer dampened by inflation and painfully high gas prices an electric vehicle tax credit never sounded so good. The purpose of the highway use fee HUF is to ensure a more fair contribution to the Commonwealth Transportation Fund from fuel-efficient and electric vehicles using highways. The credit begins to phase out for a manufacturer when that manufacturer sells.

Beginning January 1 2022 a resident of the Commonwealth who purchases a new electric motor vehicle from a participating dealer shall be eligible for a rebate of 2500. Box 26668 Richmond VA 23261. Find Your 2022 Nissan Now.

A tax credit reduces the total amount of income tax an individual owes the federal government. Claim the credit against the following taxes administered by Virginia Tax. Either fax your application to 804 367-6379 or mail it to.

Tax Credits Virginia Tax Credits Review the credits below to see what you may be able to deduct from the tax you owe. The credit amount will vary based on the capacity of the. Electric Vehicles An annual highway use fee will be assessed on each electric motor vehicle registered for highway use in Virginia.

Ad Here are some of the tax incentives you can expect if you own an EV car. Theres good news on the local front on electric vehicle tax incentives and rebates in Virginia. Several states and local utilities offer electric vehicle and solar incentives for customers often taking the form of a rebate.

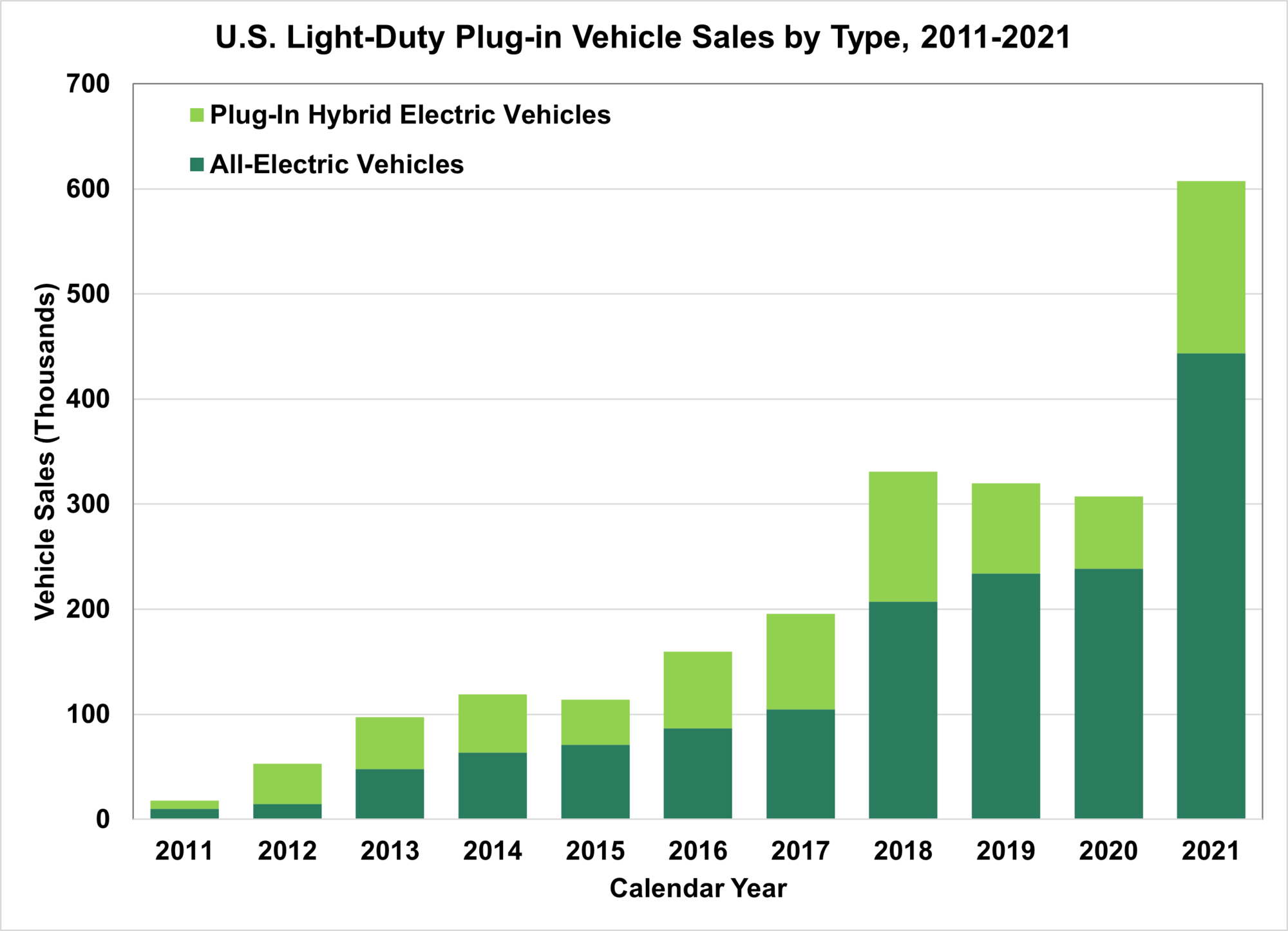

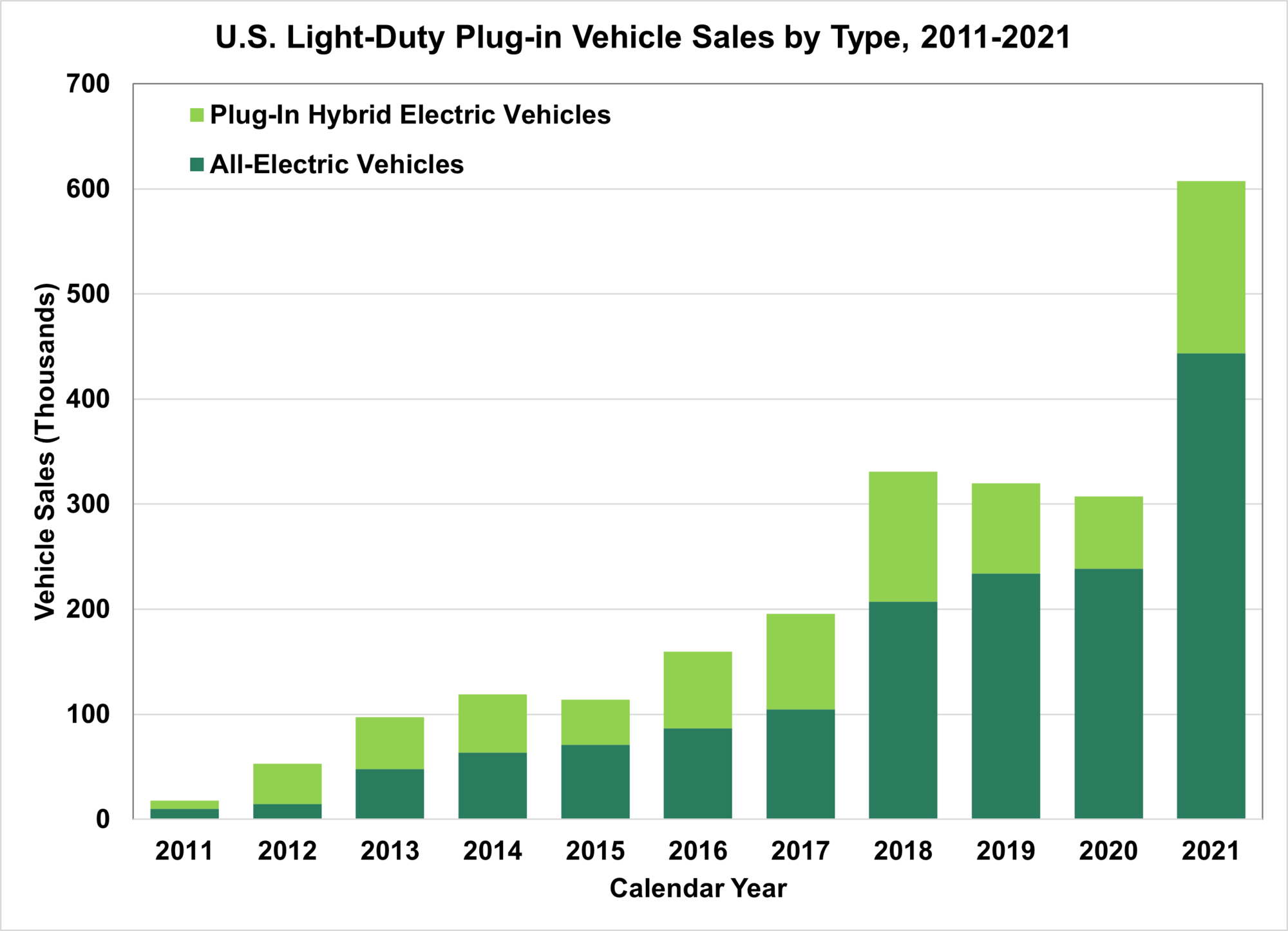

New Plug In Electric Vehicle Sales In The United States Nearly Doubled From 2020 To 2021 Department Of Energy

Why You Can T Get A Tax Credit For That New Electric Vehicle Texas Standard

A Bigger Tax Credit For Going Electric What It Could Mean For Consumers Forbes Wheels

Filing Tax Form 8936 Qualified Plug In Electric Drive Motor Vehicle Credit Turbotax Tax Tips Videos

Which States Have The Most Electric Cars Wane 15

Electric Vehicles Need More Women Buyers

Electric Cars With The Longest Range On Sale Now In The Us

Here S How Manchin S Climate Deal Could Make Energy Bills Cheaper Bloomberg

Electric Vehicle Subscription Program In Marion County Inside Indiana Business

Electric Vehicle Incentives In 3 5 Trillion Budget Could Hit Bumps The Washington Post

What Is A Plug In Hybrid Electric Vehicle Forbes Wheels

Electric Vehicle Charging Is A Growing Credit Card Rewards Category Bankrate

A Bigger Tax Credit For Going Electric What It Could Mean For Consumers Forbes Wheels

The 5 Best Ev Etfs Electric Vehicles Etfs For 2022

Electric Car Charging Stations In Community Associations Five Things To Consider The Ksn Blog

A Bigger Tax Credit For Going Electric What It Could Mean For Consumers Forbes Wheels

Ev Rebates A Complete Guide Enel X

Tesla Now Doesn T Let Anyone Buy Their Car After Lease Is Over As Used Car Prices Are Skyrocketing Electrek