salt tax deduction california

Then in December 2017 The Tax Cuts and Jobs Act TCJA capped the SALT deduction at 10000 thereby limiting a taxpayers itemized deductions and tax benefits. The Supreme Court on Monday declined to review a challenge to the 10000 ceiling imposed on the state and local tax SALT deduction one of the most controversial provisions of the 2017 tax bill.

Coping With The Salt Tax Deduction Cap Cpa Practice Advisor

A deduction against income derived from domestic manufacturing activities.

. This cap applies to state income taxes local income taxes and property taxes. The federal tax deduction for state and local tax SALT for taxpayers who itemize deductions was cut from unlimited to 10000 in 2018. Domestic Production Activities Deduction.

Plus state and local income taxes combined. States with high income taxes account for most SALT deductions. 150 on July 16 2021.

Look at line 5a of your previous years Schedule A. At one time you could deduct as much as you paid in taxes but TCJA limits the SALT deduction to 10000 or just 5000 if youre married but file a separate tax return. The change may be significant for filers who itemize deductions in high-tax states and currently can.

For example California may charge sales and use tax if you buy a mobile home. In this episode of the SALT Shaker Podcast Eversheds Sutherland Associate Jeremy Gove teams up with Associate Cyavash Ahmadi to discuss the complexities of combined reporting specifically comparing and contrasting the combined reporting regimes in New York and California. The state and local tax SALT deduction allows taxpayers of high-tax states to deduct local tax payments on their federal tax returnsThe tax plan signed by President Trump in 2017 called the Tax Cuts and Jobs Act instituted a cap on the SALT deduction.

The domestic production activities deduction is designed to encourage domestic. A 10000 ceiling on the previously unlimited SALT. While the House package raises the SALT deduction limit to 80000 through 2030.

HR Block has been approved by the California Tax Education Council to offer The HR Block Income Tax Course CTEC 1040-QE-2355 which fulfills the 60-hour qualifying education. House Democrats spending package raises the SALT deduction limit to 80000 through 2030. They discuss several of the nuances of both states systems and even debate what.

The Supreme Court will not revive an attempt by New York and three other states to overturn the Trump-era 10000 cap on state and local tax deductions known as SALT. The 2020 SALT deduction. This is known as the SALT deduction.

The SALT deduction which stands for State and Local Taxes was perhaps the most controversial part of the changes to the individual tax code made by the Tax Cuts and Jobs. Unfortunately that legislation currently includes a limitation on the use of the credit that significantly limits the benefit of making the election. The state and local tax deduction or SALT deduction for short allows taxpayers to deduct certain state and local taxes on their federal tax returns.

2021 Tax Deduction Limits. The deduction for state and local taxes is no longer unlimited. In particular California filers accounted for 21 of national SALT deductions in 2017 based on the total value of their SALT.

The SALT deduction was a major tax benefit for individual taxpayers in high-income and high property-states like California. So make sure to check your state and local sales taxes to get a better idea of the taxes you may be responsible for. Your refund isnt taxable if the box there is checked.

California became one of the 19 states and counting that has enacted its own pass-through entity tax election statute as a workaround to the federal 10000 limitation on the state tax deduction when it enacted AB. Starting with the 2018 tax year the maximum SALT deduction available was 10000. Owners who participate may then claim a credit on.

Or you could choose to use sales tax instead of income tax. California is considering similar SALT Deduction legislation while Connecticut already enacted similar legislation earlier this year. The IRS wants you to indicate by checking the box at line 5a if youre deducting sales taxes rather than income taxes and theres no correlation between taking a sales tax deduction and your state tax refund.

How Does The Deduction For State And Local Taxes Work Tax Policy Center

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

The State And Local Tax Deduction Explained Vox

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

What S The Deal With The State And Local Tax Deduction Publications National Taxpayers Union

The State And Local Tax Deduction Should Be On The Table Committee For A Responsible Federal Budget

State Tax Deduction Workaround Capata Cpa

The Best Restaurants In San Francisco Classylifestyle Com San Francisco Restaurants San Francisco Visit San Francisco

Repealing The Federal Tax Law S Cap On State And Local Tax Salt Deductions Is No Improvement Itep

State And Local Tax Salt Deduction Salt Deduction Taxedu

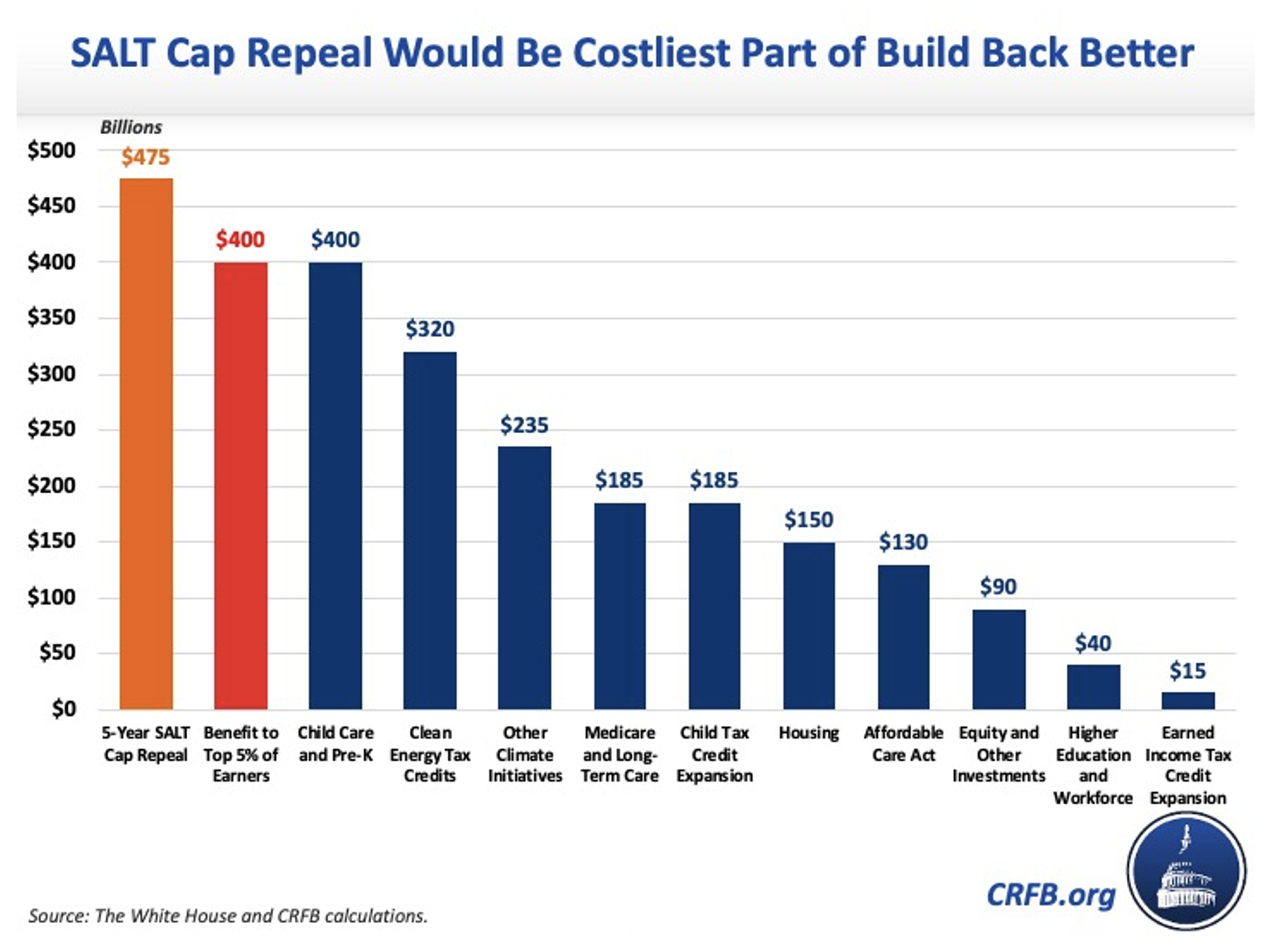

Dems Hike Taxes On Middle Class To Pay For 475b Salt Tax Shelter For Rich Ways And Means Republicans

How Does The Deduction For State And Local Taxes Work Tax Policy Center

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

Keep Calm Inspiration Keep Calm Calm Photography Love Quotes

States Where It S Easiest To Get Help Filing Taxes Smartasset Filing Taxes Online Taxes Tax Software

States Where It S Easiest To Get Help Filing Taxes Smartasset Filing Taxes Online Taxes Tax Software

U S Lawmakers Pepper Congress With Pleas For Salt Tax Break Florida Phoenix

How To Win Your Personal Injury Claim Personal Injury Claims Injury Claims Mesothelioma

States Where It S Easiest To Get Help Filing Taxes Smartasset Filing Taxes Online Taxes Tax Software

California Solution For Federal State And Local Tax Salt Deduction Limitation Hayashi Wayland