idaho sales tax rate in 2015

The Idaho sales tax rate is currently. Tax Rate.

Using The Tax Structure For State Economic Development Urban Institute

S Idaho State Sales Tax Rate 6 c County Sales Tax Rate.

. There is no applicable county tax city tax or special tax. Ad Find Out Sales Tax Rates For Free. One important thing to know about Idaho income taxes is that Social Security income.

This includes hotel liquor and sales taxes. The 6 sales tax rate in Idaho Falls consists of 6 Idaho state sales tax. The Idaho use tax should be paid for items bought tax-free over the internet bought while traveling or transported into Idaho from a state with a lower sales tax rate.

Idaho enacted its sales and use tax in 1965 and it was approved by the electorate during the 1966 election. The 2018 United States Supreme Court decision in South Dakota v. An alternative sales tax rate of 6 applies in the tax region Canyon which appertains to zip codes 83651 83652 and 83653.

The County sales tax rate is. Free sales tax calculator tool to estimate total amounts. Average Sales Tax With Local.

You can print a 6 sales tax table here. Counties and cities can charge an additional local sales tax of up to 25 for a maximum possible combined sales tax of 85. Resort cities have a choice in whats taxed and can include everything thats subject to the state sales tax.

There is no applicable county tax city tax or special tax. 270 rows Idaho Sales Tax. Fast Easy Tax Solutions.

3 lower than the maximum sales tax in ID. Sr Special Sales Tax Rate. The Nampa Idaho sales tax rate of 6 applies to the following four zip codes.

Local level non-property taxes are allowed within resort cities if approved by 60 majority vote. The Idaho use tax rate is 6 the same as the regular Idaho sales tax. Look up 2021 Idaho sales tax rates in an easy to navigate table listed by county and city.

With local taxes the total. Idaho has state sales. Higher sales tax than 95 of Idaho localities.

Wayfair Inc affect Idaho. So whilst the Sales Tax Rate in Idaho is 6 you can actually pay anywhere between 6 and 9 depending on the local sales tax rate applied in the municipality. These local sales taxes are sometimes also referred to as local option taxes because the taxes are decided by the voters in the community affected.

Idaho State Tax Commission. Plus 65 of the amount over. The Idaho state sales tax rate is 6 and the average ID sales tax after local surtaxes is 601.

The table below summarizes sales tax rates for Idaho and neighboring states in 2015. Did South Dakota v. An alternative sales tax rate of 6 applies in the tax region Ada which appertains to zip codes 83686 and 83687.

Idaho State sales Tax rate is currently 6. Plus 45 of the amount over. 3 lower than the maximum sales tax in ID.

Depending on local municipalities the total tax rate can be as high as 9. 31 rows The state sales tax rate in Idaho is 6000. Did South Dakota v.

You can print a 6 sales tax table here. There is no applicable county tax city tax or special tax. Including local taxes the Idaho use tax can be as high as 2500.

10 of the amount over 0. The 2018 United States Supreme Court decision in South Dakota v. The sales tax rate in Idaho for tax year 2015 was 6 percent.

Has impacted many state nexus laws and sales tax collection requirements. The Hammett sales tax rate is. Depending on local municipalities total tax rate can be as high as 9.

3 lower than the maximum sales tax in ID. Wayfair Inc affect Idaho. STATE OF IDAHO Sales Tax Bracket Schedule - 6 Rate Effective 10-01-06 012 020 001 021 037 002 038 053 003 071 087 005 088 103 006 104 120.

The sales tax jurisdiction name is Idaho Falls Auditorium District Sp which may refer to a local government division. The original Idaho state sales tax rate was 3 it has since climbed to 6 as of October 2006. Plus 31 of the amount over.

L Local Sales Tax Rate. The table also notes the states policy with respect to types of items commonly exempted from sales tax ie food prescription drugs and nonprescription drugs. Has impacted many state nexus laws and sales tax.

Sales Tax Rate s c l sr. Some Idaho resort cities have a local sales tax in addition to the state sales tax. The sales tax jurisdiction name is Valley which may refer to a local government division.

Prescription Drugs are exempt from the Idaho sales tax. 83651 83653 83686 and 83687. This is the total of state county and city sales tax rates.

The 6 sales tax rate in Cascade consists of 6 Idaho state sales tax. The Idaho City sales tax rate is. Plus 55 of the amount over.

Local level non - property taxes are allowed within resort cities if approved by a 60 majority vote. The Idaho ID state sales tax rate is currently 6. This includes hotel liquor and sales taxes.

The 6 sales tax rate in Boise consists of 6 Idaho state sales tax.

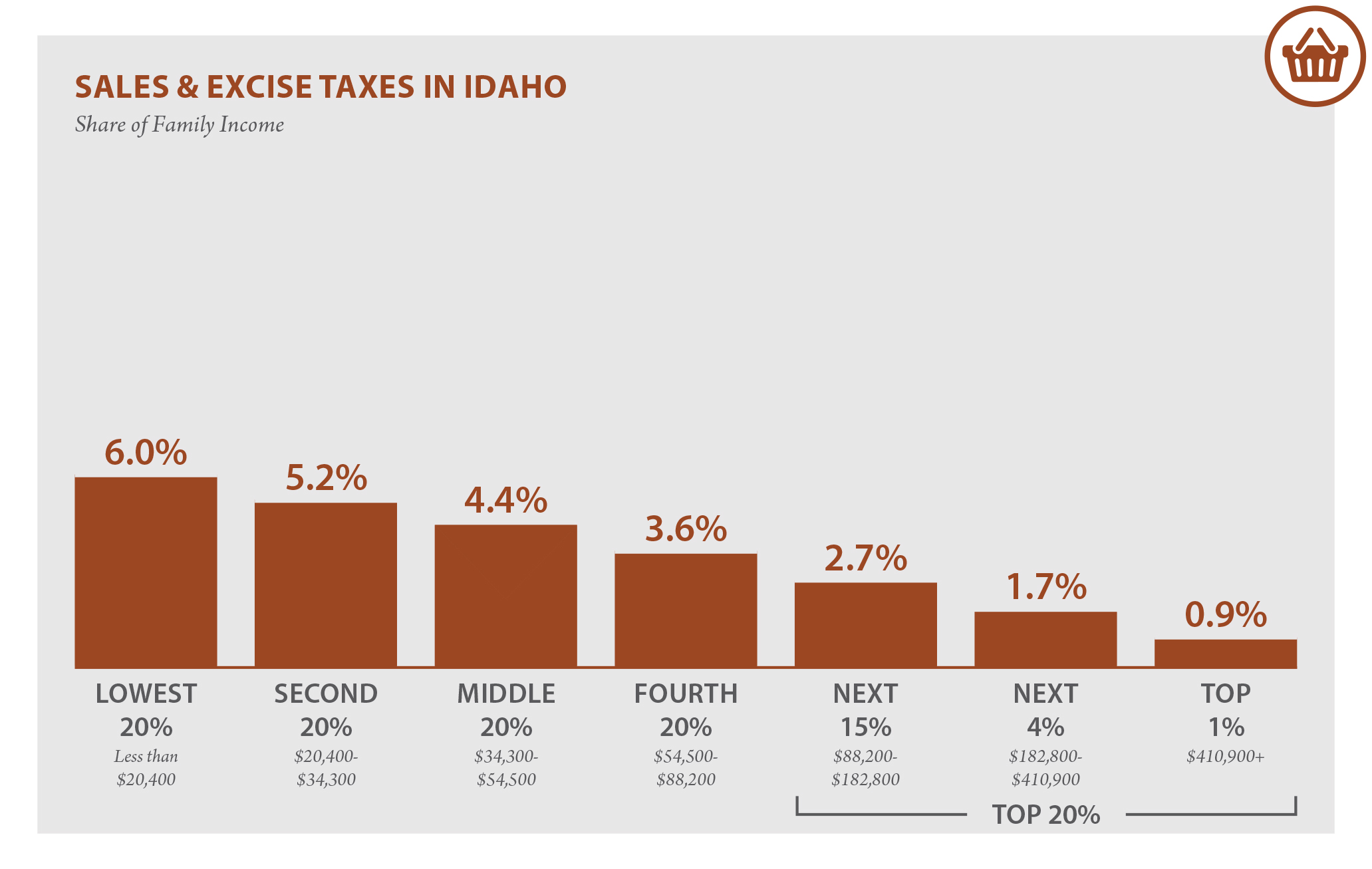

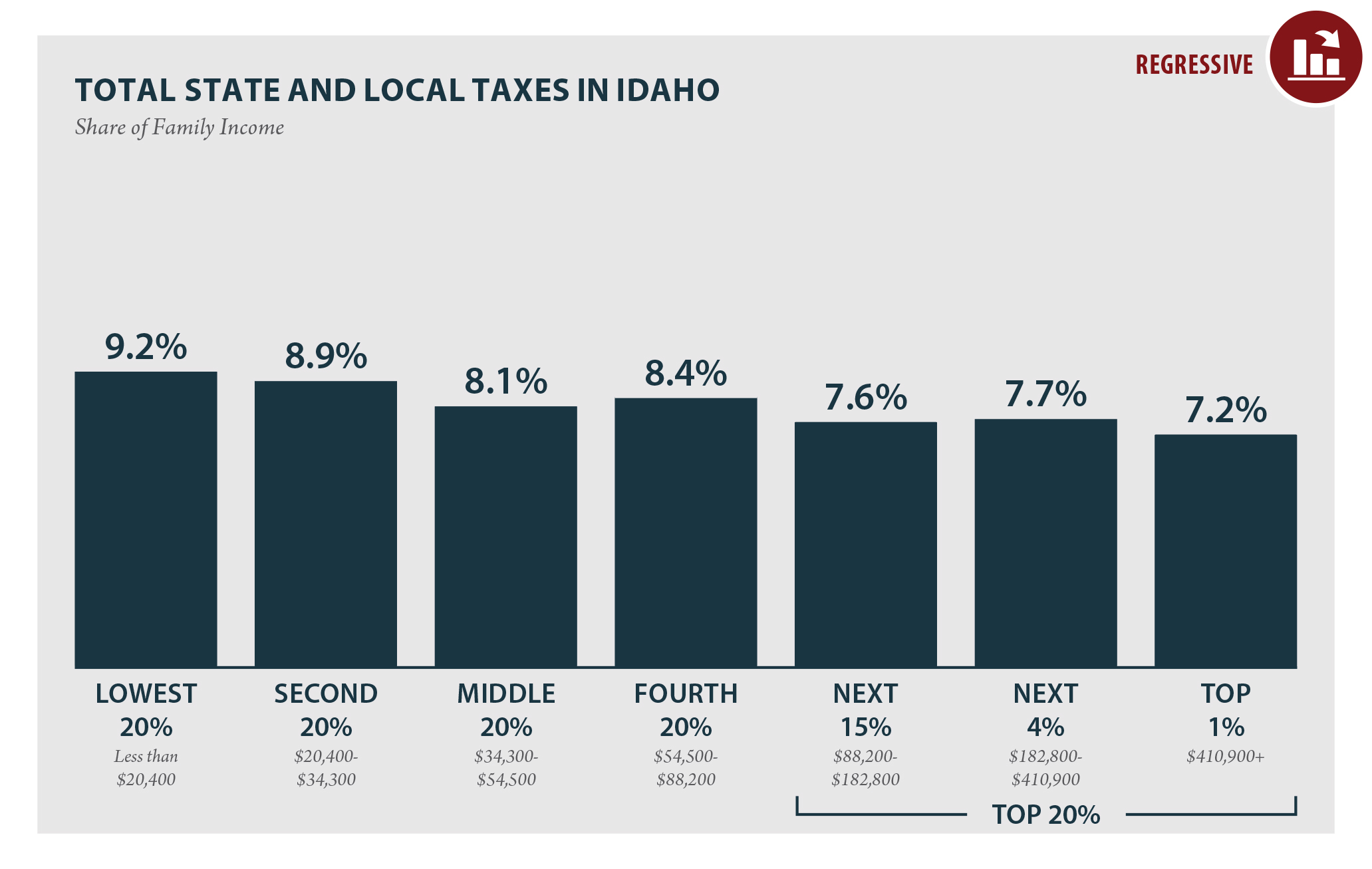

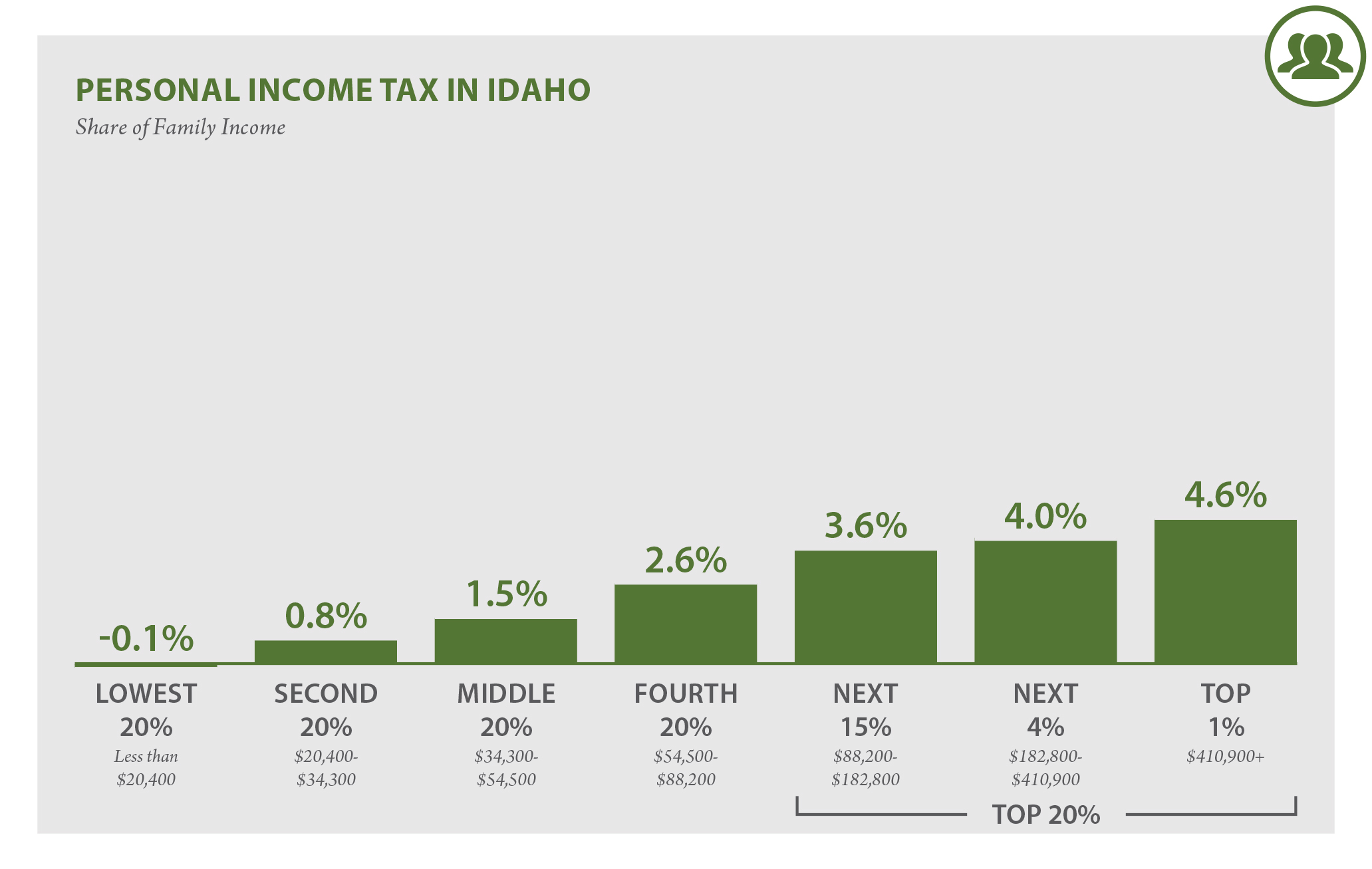

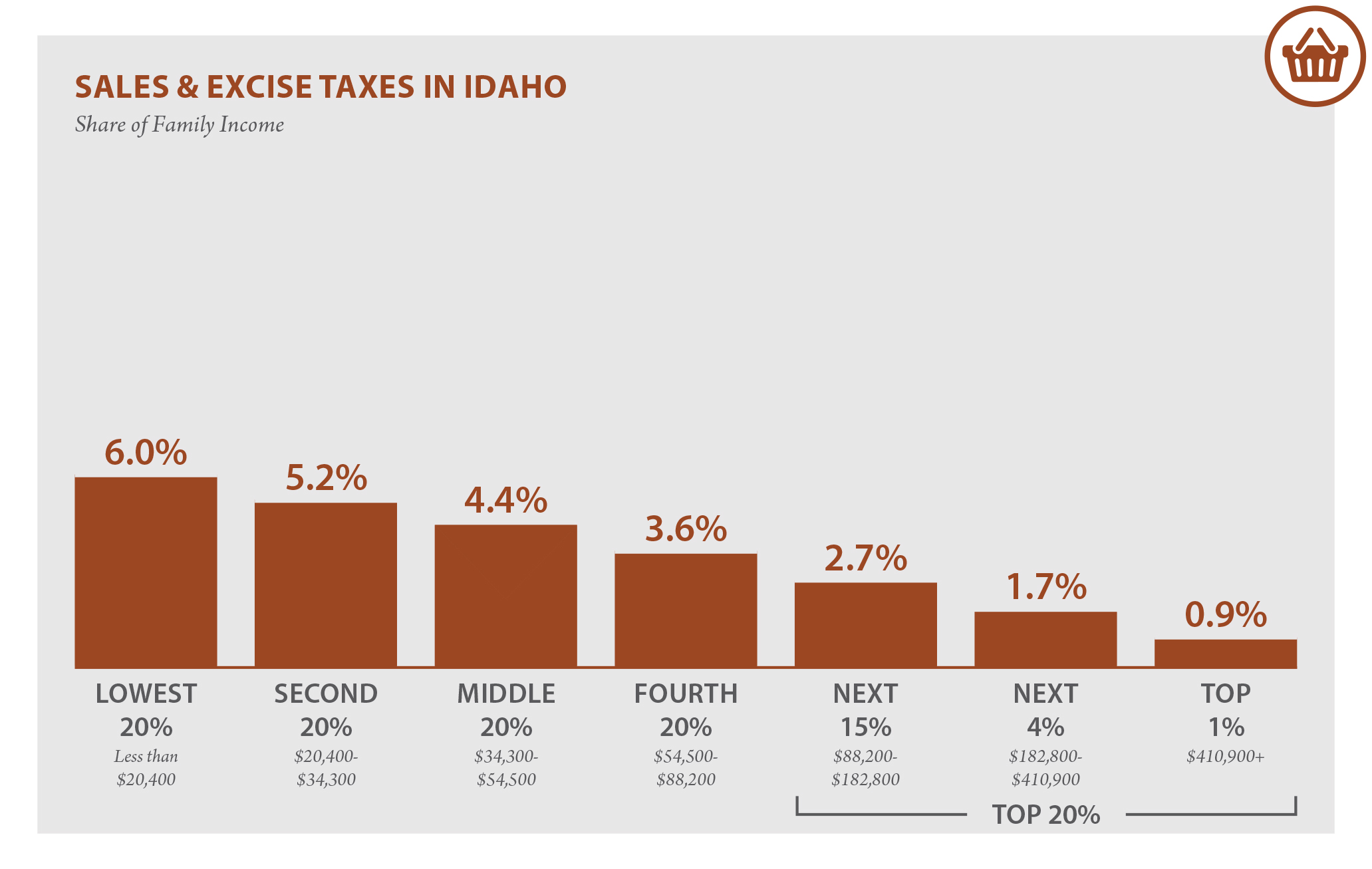

Idaho Who Pays 6th Edition Itep

Sales Tax By State Is Saas Taxable Taxjar

Historical Idaho Tax Policy Information Ballotpedia

How To Charge Your Customers The Correct Sales Tax Rates

Combined State And Local General Sales Tax Rates Download Table

State Corporate Income Tax Rates And Brackets Tax Foundation

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Sales Taxes In The United States Wikiwand

Sales Taxes In The United States Wikiwand

Idaho Who Pays 6th Edition Itep

How Idaho S Taxes Compare To Other States In The Region Boise State Public Radio

Idaho Who Pays 6th Edition Itep

State And Local Sales Tax Rates Midyear 2014 Tax Foundation

How High Are Cell Phone Taxes In Your State Tax Foundation

Oregon S Business Taxes Tied For Lowest In The Nation Oregon Center For Public Policy

States With Highest And Lowest Sales Tax Rates

How Idaho S Taxes Compare To Other States In The Region Boise State Public Radio

Using The Tax Structure For State Economic Development Urban Institute